Beyond Risk: Seeing Climate Change as an Opportunity

By Mandar Bhagwat

Sign up for our monthly newsletter!

2023 Trending Risks

How many CEOs and business leaders worldwide are losing sleep over a climate risk for their business? Based on the Harris Poll and sponsored by Google Cloud for nearly 1500 global executives, ESG has moved from the # 1 organization priority in 2022 to the # 3 priority in 2023. The report says economic headwinds have made optimizing client relationships and improving revenue # 1 and # 2. Based on the survey conducted by Statista Research Department, amongst the 21,000 global respondents, 40% chose ‘Inflation’ as the topmost worry, followed by ‘Poverty and Social inequality’ (31%) and Unemployment (27%); Climate change stood at 8th position voted by 16% responders. Nearly 1200 C-suite executives responded to the survey run by The Conference Board, highlighting ‘Recession’ as the most significant risk, followed by ‘Inflation.’

For the C-Suite executives, ‘Inflation’ seems to be at the top of their list of risks. The paper published in December 2022 by International Monetary Fund (IMF) on ‘The effects on climate change’ points out that the top risks, such as ‘inflation,’ get proportionately amplified with worsening climate change and a rise in the number of extreme climate events. As per the paper, unmitigated climate change will lead to increasingly costly economic and financial costs and hinder development. Moreover, the unpredictable nature of climate-induced natural disasters and the associated uncertainty makes economic decisions more complex.

Climate risk is real

Because of climate change, many countries are experiencing declining GDP and loss of income. For example, The Hindu news agency reported that India suffered an income loss of $159 billion, 5.4% of its gross domestic product, in the service, manufacturing, agriculture, and construction sectors due to extreme heat in 2021. Heat exposure in the country led to the loss of 167 billion potential labor hours. The decline in labor productivity will be 2.1 times more if the global temperatures increase by 2.5°C and 2.7 times more at a +3°C scenario. In addition, the annual expected damage from tropical cyclones and river flooding at 3°C is 4.6 to 5.1 times that from 1.5°C. There are other similar examples as per the African Development Bank. Africa loses up to 15% of its GDP per capita annually because of climate change.

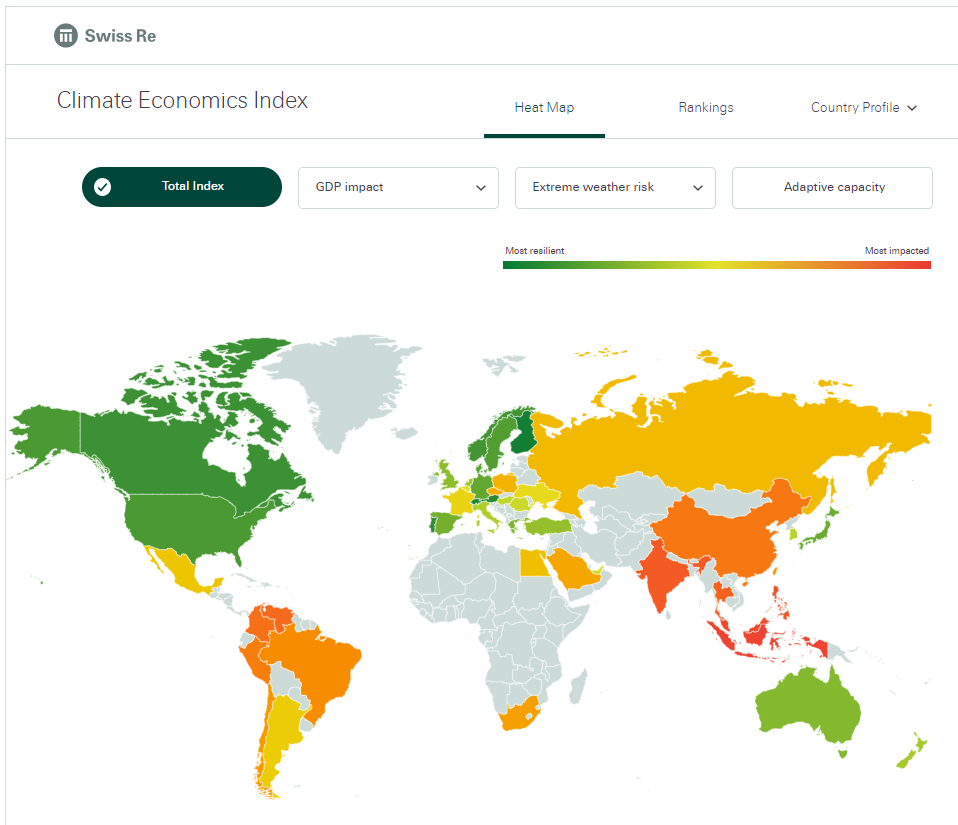

The economics of climate change report published by the Swiss Re Institute claims that by mid-century, the world will lose around 10% of total economic value from climate change. The economies in the south and southeast Asia are particularly vulnerable to adverse effects of climate change, and the advanced economies in the northern hemisphere are the least affected.

The effect of adverse climate change on Global GDP by 2050 is projected in the points below:

- -18% if no climate mitigation actions are taken (3.2°C increase scenario)

- -14% if some mitigating actions are taken (2.6°C increase)

- -11% if further mitigating actions are taken (2°C increase)

- -4% if Paris Agreement targets are met (below 2°C increase).

Based on the Deloitte report, by 2070, mounting global economic losses could total US $178 trillion (in present-value terms), a future marked by significant declines in productivity, job creation, standards of living, and well-being. Some sectors are more vulnerable than others due to the workforce’s exposure to extreme climatic conditions. Also, in following sectors are exposed to productivity disruption and investment due to natural disasters. The top 5 industries that, as per the report most vulnerable are:

- Agriculture

- Conventional energy

- Heavy industry and manufacturing

- Transport

- Construction

Based on the recommendations of the Task Force on Climate-related Financial Disclosures, climate-related risks can be divided into two major categories:

- Physical Climate risks

- Transition Climate risks.

Physical risks are event-driven (acute) or associated with longer-term shifts in climate patterns (chronic). For example, extreme weather events like cyclones, hurricanes, heat or cold waves, or floods can pose financial risks related to infrastructure, supply chains, and the built environment. Chronic physical risks refer to longer-term shifts in climate patterns. For example, businesses won’t be able to do business as usual under sustained higher temperatures, sea level rise, and changing precipitation patterns. To mitigate the physical risks, organizations need to conduct climate risk assessments and employ adaptation strategies such as having more than one supplier in different geographic locations based on climate risk regions.

Transition risks are risks that occur when your business is moving away from a fossil fuels economy to a low carbon economy. Transition risks include Policy & Legal, Technology, Market, and Reputation risks. For example, innovation in transition technology may disrupt the level where old systems and ways of doing business may become void.

Climate Change Opportunities

Businesses, while mitigating climate risks, also uncover climate opportunities. Such opportunities include resource efficiencies and cost saving, low energy costs, low emission products, and service lines that will improve competitive position; innovation in product/process may lead to access to entirely new markets. In addition, organizations can develop resilience in supply chains and overall operations. The Task Force on Climate-related Financial Disclosures identifies the following five opportunity categories.

Resource Efficiencies: As part of decarbonization initiatives, organizations can optimize operational costs by improving efficiencies across manufacturing processes, distribution, upstream supply network, transportation, use of raw materials, use of water, and waste management. Resource efficiencies include adopting principles of circular design and circular economy: reuse, reduce, and recycle. In addition, organizations can start adopting energy-efficient technologies such as LEDs, smart heating, smart cooling systems, smart water management, and smart buildings – the scenarios are many. Here, smart refers to the efficient use of sensors and software/AI-driven optimization. All these efficiency actions can result in direct cost savings to organizations’ operations over the medium to long term and contribute to global efforts to curb emissions.

Energy Source: Organizations must transition from fossil fuel electricity sources to clean / low-emission alternatives to meet global emission reduction goals. Organizations shifting their energy usage toward low-emission energy sources could save on annual energy costs.

Products and Services: Consumer and market preferences are shifting. Organizations that innovate their products and service lines for a low carbon footprint will have differentiating value propositions. In the consumer space, companies are leveraging eco-labels on foods, beverages, fashion, recycling services, and many other products to highlight their efforts. Organizations in the enterprise space highlight their differentiators in renewable energy usage, energy efficiency methods, and value-chain optimization methods.

Markets: For entering a new market in a new geography, a company transitioning to a low-carbon economy can collaborate effectively with governments, development banks, small-scale local entrepreneurs, and community groups to position its products and services.

Resilience: An organization that gets on the low-carbon economy builds the adaptive capacity to handle physical and transitional climate risks and seize relevant opportunities. Resilience is particularly relevant for companies with significant investments in fixed assets, dependency on infrastructure, extensive value chain networks, and reliance on natural resources.

Stubborn Optimism

Measuring and managing climate change risks is integral for the company to manage financial risks. However, the adaptation methods present great opportunities for companies to optimize their operations and innovate products ad services; C-Suite should look at this perspective harder than only worrying about the risks climate change presents.

Mandar Bhagwat has excelled as a business expert and entrepreneur in the software and digital tech industry. He founded and nurtured a successful tech company for 16 years. He is passionate about Sustainability and particularly Climate Change.

As Ireland transitions from the rich, smoky scent of peat-burning to a more sustainable future, its olfactory heritage is evolving. What will become the next iconic aromatic symbol of Ireland?

Click to watch the documentary trailer.